Layer-2 (L2) networks are coalescing around dominant tech stacks rather than working toward universal standards, research from onchain explorer Blockscout reveals.

Speaking with Decrypt in a video interview, Ulyana Skladchikova, head of product; and Kirill Fedoseev, head of research at the open-source explorer, revealed how a shift toward technical "clustering" is happening, despite overall transaction growth.

"We see chains kind of get together around some big players and establish interop within those groups of chains," Skladchikova said.

The OP stack, for instance, has emerged as a dominant player in the L2 sector, with most networks using its tooling, real-time data from Rollup.wtf cited by Blockscout shows. This stack is a set of open-source standards used primarily on the Optimism network and its "Superchains."

Such a trend points to a "consolidation" around L2 networks, Skladchikova told Decrypt.

This also shows how "bridge abstraction," which refers to the process of simplifying how users could move assets between different chains, could become a challenge for L2 players in the long run.

Instead of contributing to a universal standard, major L2 players are developing proprietary interoperability solutions that may cause "UX friction for users," making it difficult for them to "navigate and transfer funds between networks," Blockscout said in a statement, responding to follow-up questions.

Data paradox

But the data presents a paradox: while transaction volumes on L2 networks like Base have increased nearly threefold to 80 million monthly transactions, native bridging between L1 and L2 has declined by approximately 80% since early 2024, data from Blockscout's internal research shared with Decrypt shows.

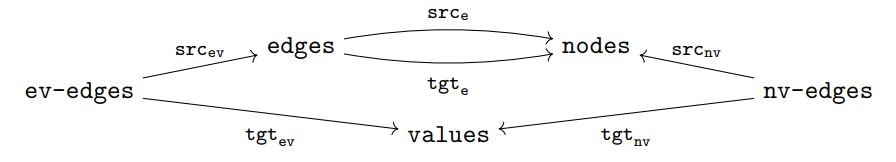

This points to an emerging challenge around "chain clustering," a phenomenon where related networks try to form shared standards for communicating with each other to help ease interoperability.

"There will be chain clusters around every large ecosystem player," Fedoseev told Decrypt.

Monthly active users per L2 chain spiked 250% in autumn 2024, reaching over 14,000 before stabilizing around 11,000.

Such a pattern signals sustained adoption rather than temporary interest driven by airdrops or speculation, Blockscout noted in a separate research document shared with Decrypt.

"Early hype doesn't always translate into sustained use." Blockscout wrote. "When users migrate from a larger established platform to a new chain, it signals better future sustainability."

With Ethereum's Pectra upgrade approaching, these consolidation patterns suggest L2s are optimizing for specific capabilities that work across chains, rather than attempting to be general-purpose scaling solutions.

If this becomes the case, "we'll have this one homogeneous interop solution that everyone will just use," Skladchikova said.